Corporate Transparency Act Resource Center

The Corporate Transparency Act (“CTA”) became effective January 1, 2024. The CTA is an attempt by the U.S. Congress to bolster national security and combat money laundering and other illicit activities. The Act requires most private businesses to report company ownership information to the Financial Crimes Enforcement Network (“FinCEN”).

The CTA is estimated to affect over 32 million existing businesses and millions of additional businesses formed each year. If an entity is formed by filing documentation with an applicable Secretary of State, whether it be a corporation or a limited liability company, then the company likely must comply with the CTA.

Burke, Warren, MacKay & Serritella's multi-disciplinary CTA Compliance Team is available to help your company understand and maintain CTA compliance. Please reach out to a member of our CTA Team listed at the right to help understand your company’s CTA reporting obligations, CTA deadlines, and reporting information.

Readers will find our most recent insights and analysis below. Check back regularly for updates from our team.

Treasury Department Announces That Corporate Transparency Act Will Not Be Applied to U.S. Citizens and U.S. Companies

March 3, 2025

CTA Compliance Back On Hold - New Rules and Deadlines To Be Announced By March 21, 2025

February 28, 2025

Injunction Lifted - Corporate Transparency Act Reporting Requirements Are Back in Effect with a New Deadline

February 19, 2025

Corporate Transparency Act Filing Requirement Reinstated for Incorporated Community Associations

February 19, 2025

Appeals Court Pauses CTA Reporting Requirements

December 27, 2024

Appeals Court Reinstates Corporate Transparency Act Reporting Requirements — Deadlines Extended by FinCEN

December 24, 2024

FinCEN Confirms Suspension of Corporate Transparency Act Filing Requirements

Alert, December 12, 2024

Texas Court Issues Nationwide Injunction on Corporate Transparency Act

December 4, 2024

Deadline Approaching for Corporate Transparency Act

December 3, 2024

New Corporate Transparency Act Requires Reporting of Company Owners to FinCEN

January 8, 2021

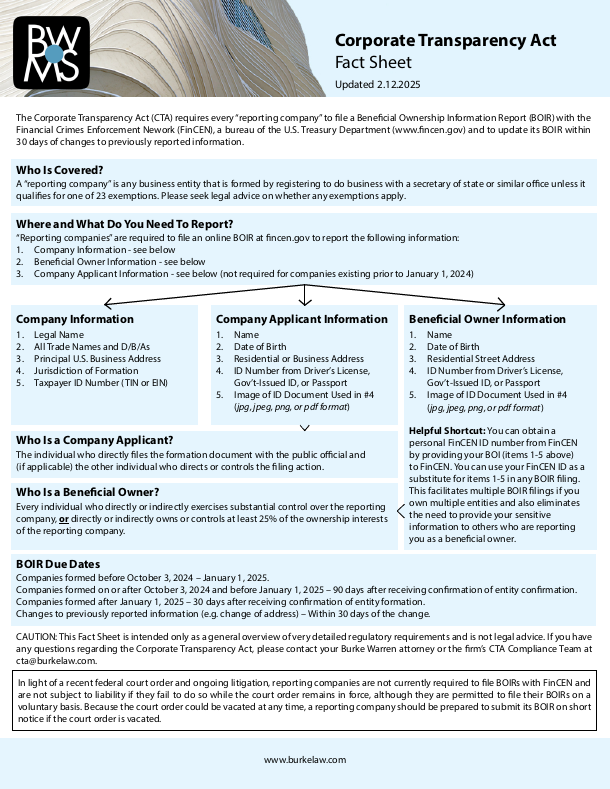

Corporate Transparency Act Fact Sheet

Click the image below to view and download a copy of our Corporate Transparency Act Fact Sheet containing a summary of the CTA's requirements at a glance.

Related Professionals

- Partner

- Partner

- Partner

- Partner

Related Practices & Industries

Sign-Up

Subscribe to receive firm announcements, news, alerts and event invitations.